Here's Everything You Need to Know about Travel Insurance in 10 Minutes

You may have heard of travel insurance, but it is not always clear why you need it, or how it protects you.

Travel insurance is explicitly designed to cover for unfortunate incidents that might occur while travelling, making sure that your holidays or business trip go as planned. It's not uncommon for travellers to experience baggage loss, delayed flights, or medical issues when they're on vacation or business trips. No matter your situation, travel insurance coverage is crucial, even if you have another policy that covers other situations.

The following information may be useful for your upcoming trip.

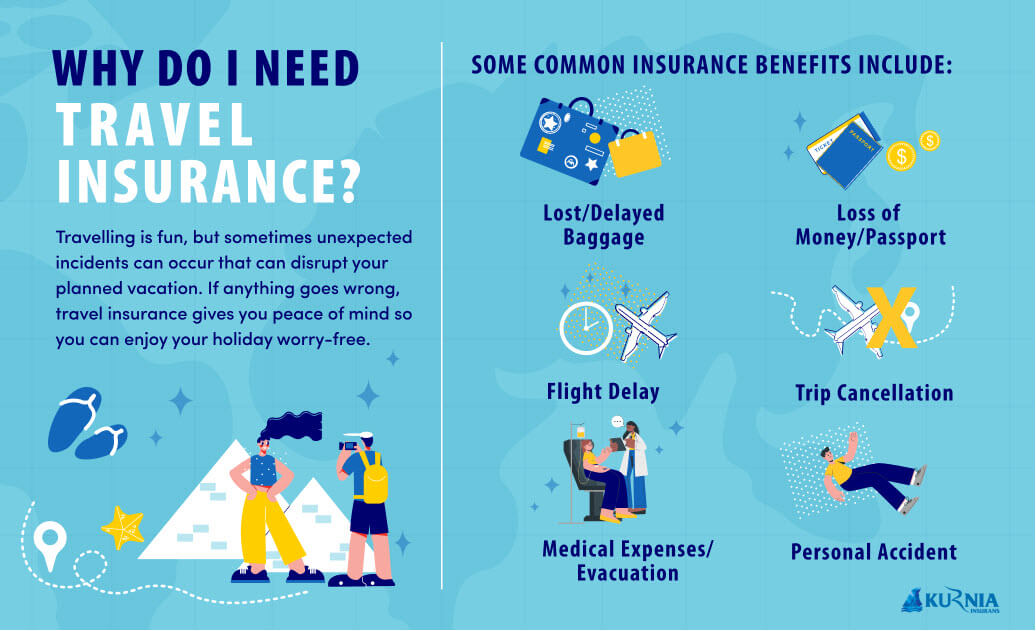

Why do you need travel insurance?

Travel insurance is a policy that protects you against certain losses and risks that might occur before or during your trip. The policy may provide a variety of benefits based on the insurer and the plan you choose. If anything goes wrong on your trip, whether it's an international flight, domestic travel, or a road trip across town, your travel insurance will compensate you.

Additionally, with travel insurance cover, you'll have access to 24-hour emergency assistance. This benefit is essential if you need immediate assistance in a foreign country during your trip. With adequate insurance coverage, your travel agent can arrange emergency medical care and evacuation smoothly.

The following scenarios illustrate how travel insurance would be helpful if something unexpected happens before or during your trip.

Before your trip:

Imagine you slipped and broke your leg two days before departure. The doctor tells you to cancel your trip because your leg needs surgery. There's no way to get a refund from the airline, but fortunately, your travel insurance covers you. The fact that serious injuries qualify as reasons to cancel a trip means that you will be reimbursed for any expenses, including your flight tickets. When you are able, get the necessary documentation, including the medical certification from your doctor, and submit a claim to your insurance company.

During your trip:

Let's imagine you checked in your luggage on your flight to Sydney, Australia, and when you arrived, it went missing. You go to the counter to check the status of your luggage and are informed that your luggage had been sent to the wrong destination. Your airline confirms this in a written report and informs you that it will take another 12 hours to deliver the luggage. In this scenario, you can file your claim for the delayed baggage upon returning home with this report and other relevant documents. Having your luggage lost during travel is highly frustrating. However, by having travel insurance, you will receive compensation once your claim is accepted.

What does it cover?

Travel insurance plans provide a variety of benefits to protect the insured during the trip. The most common ones are compensation for travel cancellation or interruption, baggage, and personal effects coverage, overseas medical expenses, and coverage for flight delays.

Your travel insurance may also cover you for medical emergencies, hospital allowances, medical evacuation, and repatriations.

Some of the popular travel insurance plans may also cover rental vehicle excess, emergency mobile phone charges, and even your home contents in case of burglary or fire while you are abroad.

There are different categories of travel insurance and a few common insurance benefits are described below.

Lost Luggage and Personal Effects Coverage

When you travel, it's not uncommon for your baggage and personal belongings to get lost or damaged. While airlines, bus companies, and train companies usually compensate you for the lost or damaged luggage, the compensation is usually limited. As part of this benefit, you are entitled to protection against such unfortunate events. Insurers provide adequate compensation for inconveniences that are comparable to the losses.

Coverage for Trip Cancellation

Trip cancellation benefits can protect you when you've invested a lot of money in planning your trip but you are unable to continue with it due to illnesses, injuries, or non-weather-related reasons. With these benefits, you may receive reimbursement for some prepaid, non-refundable expenses. You could also pay the cancellation fee with the compensation.

Medical Coverage

When travelling to a foreign country, it is critical to obtain medical coverage in case of medical emergencies. In addition, your insurance provider may offer medical costs coverage such as hospital allowances, treatment, and evacuation. Also, make sure you understand whether the travel insurance you purchase also covers pre-existing medical conditions.

Accidental Death

An accidental death occurs when a traveller is fatally injured in a sudden, violent, external, and visible accident. Even if you already have life insurance, it never hurts to have travel insurance that covers accidental death. In the event of a tragic accident, your beneficiaries will receive a higher payout and repatriation assistance.

Different travel insurance companies may offer different benefits, so be sure you pick one that meets your needs and fits your budget. A travel insurance policy like Kurnia Travel Supreme offers 22 benefits that will provide comprehensive coverage for your trip, whether it's a weekend getaway in Thailand or a month-long trek across Europe.

Covered and non-covered activities

During your travels, you will likely explore rugged terrains and possibly even engage in adrenaline-pumping activities. However, you should be aware that not every activity you plan to take part in will be covered by the insurance. Insurance companies have their own exclusions, risk guidelines, or guidelines for what isn't covered.

Travel insurance policies commonly cover the following activities:

- Scuba diving for leisure purposes

- Swimming

- Horse riding for leisure purposes

- Cycling

- Kayaking

- Hiking or trekking with a licensed guide

Here are some common exclusions in travel insurance:

- Racing

- Motor rallies

- Mountaineering and rock climbing with special equipment

- Paragliding and Skydiving

- Bungee jumping

- Martial arts

If you intend to take part in any activities that aren't covered by your insurance, you may wish to ask your insurer about acquiring extended coverage or do some research to find the most suitable policy for you.

How to choose the right plan?

There are different types of travel insurance.

First, decide what type of coverage is most important for your vacation and then set a budget.

There are plans for a single trip, multi-trips, and annual trips. Consider the annual travel insurance option if you are a frequent traveller, as it may save you time and be more cost-effective.

Compare the specific benefits and conditions of each plan. When you're on your trip, you may wish to rent a car, so you'll need specific coverage for that. Should you be concerned about leaving your house unoccupied, a plan that protects your home contents is necessary.

You should consider several factors, including the cost, the destination, the length of the trip, and who will accompany you.

Then, review the product page on the travel insurance provider's website to ensure that the plan is the best option for you. Read the brochures, the disclosure statement, and policy wording to understand the fine prints and exclusions that may apply.

Important: Getting travel insurance may prove to be one of the most crucial considerations for travellers to undeveloped countries or locations with few medical facilities. One never knows when an emergency might arise, especially when travelling with more vulnerable people, such as children, the elderly or someone with special needs. You should ensure that the plan includes emergency medical coverage, evacuation, and repatriation for you and anyone accompanying you.

When to buy?

Travel insurance should be part of your travel arrangements.

To get the most out of your travel insurance plan, purchase one as soon as you finalise your travel plans. By purchasing this insurance before your departure, you will be covered if anything unexpected occurs. Suppose a natural disaster occurs at your destination just before you depart, causing your tour cancellation. Refunds are not always possible. If you had purchased travel insurance before the unfortunate event, you'd be compensated for the trip cancellation.

How to get help?

When it comes to a minor incident like losing your luggage, you should stay calm and request help from local authorities first. Nevertheless, you can call an insurer's emergency hotline if the situation is urgent and you need immediate assistance. If you are a Kurnia customer, you can contact our emergency service provider, Asia Assistance Network, through their 24-hour hotlines at 03-7841 5750 and 03-7628 3770.

Travel insurance claims are submitted in the same way as for other policies. For Kurnia Travel Supreme Claims, you must complete and submit the claim form together with any supporting documentation. It is a simple process, and our hotline can help if needed.

Getting the Quote and Purchasing Travel Insurance

It shouldn't take you more than a few minutes to obtain travel insurance. Answer a few questions, examine the benefits, and then decide. Kurnia makes getting the proper protection quick and straightforward. For example, getting the quote for Kurnia Travel Supreme online is as simple as filling in your details and trip dates, and then choosing a plan that suits your needs.

You can also contact your preferred agent or visit any of our branches near you to purchase your travel insurance policy.

Disclaimer: This blog post is strictly for informational purposes, and should not be taken as advice of any kind. Kurnia disclaims all responsibility for any losses resulting from reliance on the information contained in this article.

Liberty General Insurance Berhad is a member of Perbadanan Insurans Deposit Malaysia (PIDM). PIDM protects the benefit(s) payable under the eligible policy up to protection limits. Please refer to PIDM's TIPS Brochure or PIDM's Website, or contact our customer service.