Insure Your Car Against Natural Disasters with Special Perils Coverage

You might need more than just standard motor insurance to protect your vehicle. In Malaysia, natural disasters such as floods and landslides can cause severe damage to your car and may not be covered under standard policies. That's why Special Perils coverage is so essential.

This blog post will explain the benefits of Special Perils coverage. You'll learn what it covers, how to get it, and real-life scenarios where it can benefit you.

What is Special Perils Coverage

Special Perils is an add-on to a standard motor insurance policy that provides additional benefits and protection for motor vehicles. Special Perils is designed to cover damages or losses caused by natural disasters or other particular perils not covered by standard motor insurance policies, such as floods, landslides, earthquakes, and other convulsions of nature.

Perils like natural disasters are considered "special perils" due to their rarity.

Who Needs It

All motor vehicle owners living in high-risk areas or frequent places prone to natural disasters should consider Special Perils coverage.

For example, living in flood-prone areas puts you at risk, so your insurance company may compensate you if you have special perils coverage. Depending on your insurance plan, the compensation can cover the cost of flood damage repairs and replacement parts for your car. Repairs of flood-affected vehicles can be expensive, so this coverage can help ease the financial burden.

Real-life scenarios in Malaysia

Floods and landslides are frequent during the monsoon season in Malaysia. However, many Malaysian cars aren't adequately protected from these natural disasters.

The destructive floods in December 2021 made us realise that getting flood coverage for our cars is more important than ever. Malaysia's Department of Statistics reported that vehicle losses alone due to the flood that year cost RM1 billion.

Because of this event, the General Insurance Association of Malaysia (PIAM) recommends that all vehicle owners review their insurance policies and ensure extra coverage for natural disasters like floods. The good news is that more and more people are starting to realise the importance of this coverage, and PIAM subsequently reported that more people bought it in 2022 than in 2021.

What Does Special Perils Cover

Some events are commonly covered by Special Perils but not by standard motor insurance:

- Floods

- Landslip and Landslide

- Typhoons, Storms, and Hurricane

- Tempest

- Volcanic eruption

- Earthquake

- Subsidence or sinking of the soil/earth

- Other convulsions of nature

Are there exclusions?

Special Perils only covers convulsions of nature, so other events like strikes, riots, and civil commotion aren't covered.

Insurance coverage can differ depending on your chosen insurance company and policy. Please read and understand the policy details to know what your Special Perils add-on covers.

How Much Does the Special Perils Add-on Cost

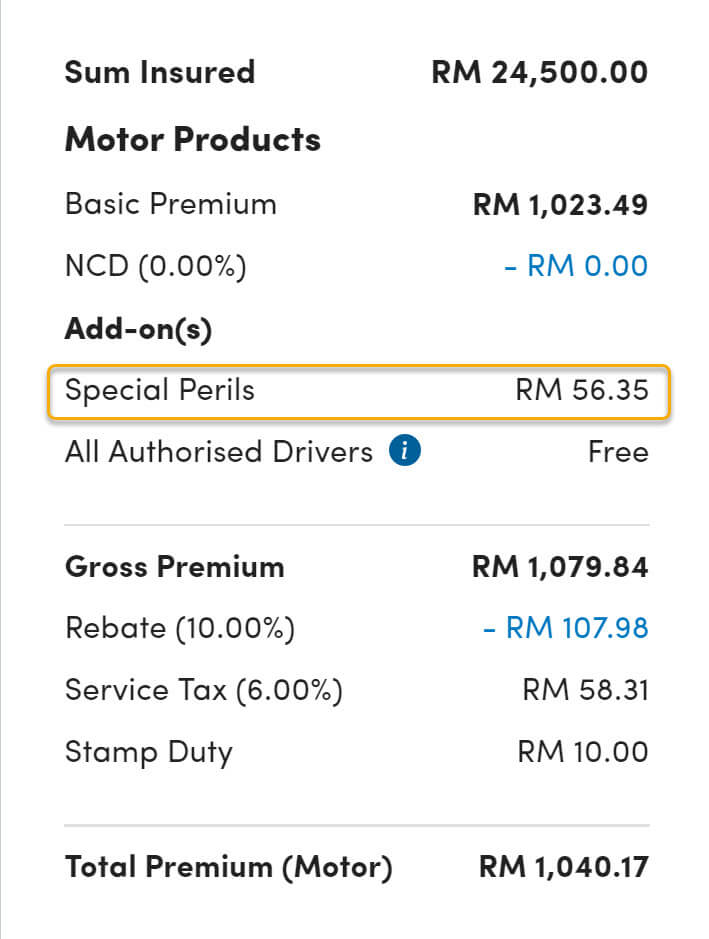

Depending on your insurance company, you can add Special Perils benefits to your car insurance policy for an additional premium of around 0.2% to 0.5% of the vehicle's sum insured. That means if your car's sum insured is RM50,000, you will only pay an additional premium of RM100 to RM250. As with standard motor insurance, a small government service tax is usually applied to the insurance quote.

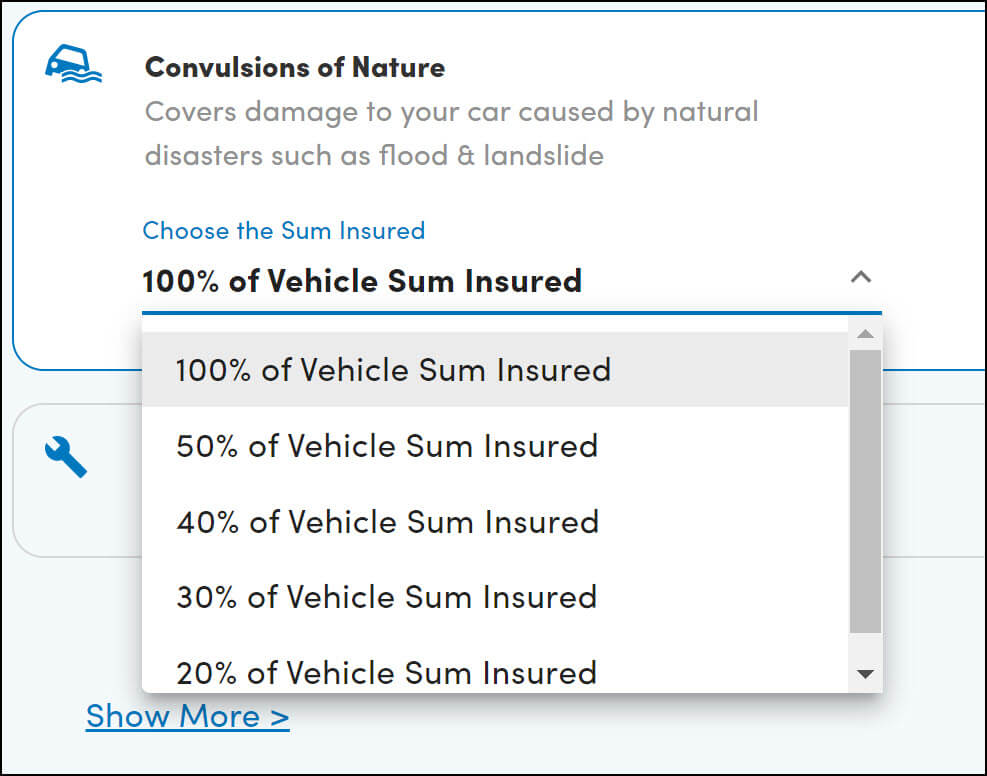

If you are Kurnia's customer, you'll get a highly competitive rate for Special Perils when you renew your car insurance with us. Furthermore, you can choose either full coverage (100% of the vehicle sum insured) or partial coverage options as low as 20% of the vehicle sum insured. However, full coverage (100% of the vehicle sum insured) is recommended since flood damage can be very costly.

How to Purchase Special Perils Coverage

There are a few ways to get the Special Perils add-on.

First, determine if your current motor insurer offers special perils coverage as an add-on to your existing policy. Commercially the coverage might be known as Special Perils, Convulsions of Nature, or Flood Insurance Coverage.

You can discuss with them what is covered and see if it works for you.

If your current insurance provider doesn't offer special perils coverage or you are unsatisfied with their plans and benefits, you can compare insurance plans from other insurers.

Comparing coverage means taking into account the level of coverage and the price. You'll want to ensure you get the most comprehensive coverage possible. Make an informed decision by reading and comparing the coverage details, exclusions, and terms offered by different providers.

Many Malaysian insurers provide this coverage as an add-on or extension to your standard comprehensive car insurance policy rather than a standalone one. So, when you renew your car insurance, that is the time you can pick the add-on once you have decided on your main car insurance plan.

Whether you are new to Kurnia or an existing customer, you can add special perils coverage seamlessly during policy renewals and pick the percentage of the insured sum you want. Once you add Special Perils coverage, your final premium will automatically adjust.

Note that if you've chosen our auto365 Comprehensive Premier policy, the Special Perils add-on is referred to as "Inclusion of Convulsions of Nature."

Making Claim

Generally, the claims process for Special Perils is the same as general car insurance claims, but it may vary for different insurers. Remember to read the policy details and understand how the claims process works before you purchase the policy.

You'll need to provide documentation of the damage to your insurance company. Then your insurer will assess the damage and see if it's covered.

As an example, for a flood-affected car, the process typically goes like this:

- Remain calm and ensure that you are safe from any immediate danger.

- If you suspect the flood might have affected the engine, don't try to start your car immediately. Doing so could damage the engine further.

- Also, don't clean your car if it's covered in mud, water, or other debris.

- Take as many photos and videos as possible of the damage to your car, including the interior and exterior. Also, take pictures of the surroundings.

- After documenting the damage, call your insurance company ASAP and tell them what happened. They will guide you and give you further instructions on what to do. Kurnia customers can call our 24-hour free hotline at 1 800 88 3833.

- The next step will be getting your car to an approved repair shop and initiating the claim process. Your insurance company might ask for more documents or photos to support the claim.

"Will I lose my No-Claim Discount (NCD) if I claim?"

The answer is yes; if you claim vehicle damage or total loss, it'll be treated as a regular claim, and the NCD will be affected.

Conclusion

The best way to keep your car safe is to reduce the chances of anything happening to it. We can achieve that by understanding the risk, especially on the road. While we can't control Mother Nature, we can always stay alert and avoid driving in dangerous conditions. Stay safe!

Disclaimer: This blog post is strictly for informational purposes, and should not be taken as advice of any kind. Kurnia disclaims all responsibility for any losses resulting from reliance on the information contained in this article.