Road Tax Renewal Price in Malaysia

Your car insurance and road tax can be a significant expense when you own a vehicle in Malaysia. Thus, it is helpful to know how they are calculated and the latest prices to help you plan your budget. Also, if you are planning on purchasing a car, you need to know how much money you will spend on road tax and other related expenses.

While different insurers have different premium prices, the pricing of road tax is set by the Road Transport Department Malaysia (Jabatan Pengangkutan Jalan or JPJ) based on a fixed formula. However, the amount of money that is paid to the government every year varies depending on several factors.

We have put together these helpful guidelines for road tax in Malaysia to help you calculate the cost.

What is road tax?

Though it is commonly called road tax, it is officially known as a Motor Vehicle License (LKM) as stated in the Road Transport Act 1987.

The road tax that you renew every year is paid to the government, and the money is deposited into a Consolidated Fund. The fund is used to build and improve our transportation infrastructure, including public transport.

How is road tax calculated?

Malaysia has a unique system of calculating and pricing road taxes, which we describe in more detail below.

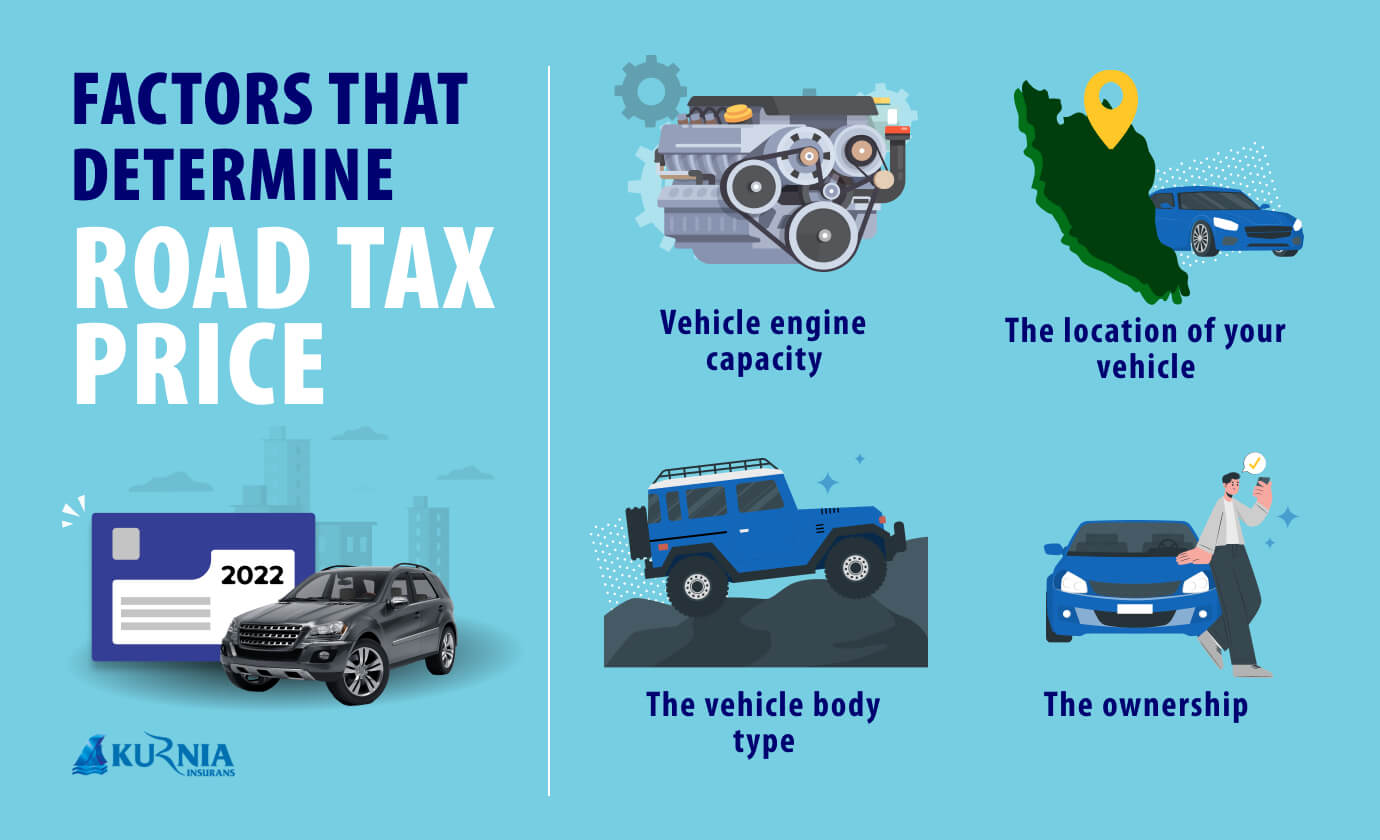

There are only four factors that determine the price of your car's road tax. These are:

- your car's engine capacity

- the location of your vehicle

- the vehicle body type

- the ownership

The rates are not affected by a car's value or its brand.

For motorcycles, only two factors determine the rate, namely the engine capacity and the location.

Engine Displacement/Capacity

The larger your engine (measured in cubic capacity (cc)), the more expensive your road tax will be. Whether it is a petrol or diesel engine does not affect the road tax rate.

Tip: You can usually tell the capacity of your vehicle by the number that follows the model name. For example, a Proton Saga 1.3 has a 1300cc engine, and a Saga 1.6 comes with a 1600cc engine.

RM20 is the base rate for cars in all regions, whereas RM2 is the base rate for motorcycles; the price increases progressively depending on the size of your engine. There are fixed flat rates up to 1600cc (between RM 20 to 90), but progressive rates kick in after 1600cc for cars.

Geographical Location

Your vehicle's geographical location influences the price of your road tax as well. In general, motorists in East Malaysia (Sabah & Sarawak) pay lower rates than those in Peninsular Malaysia.

Motorists are often confronted with narrow roads and bad roads due to the region's challenging geographical conditions and less developed infrastructure. Therefore, many East Malaysians prefer to buy four-wheel-drive vehicles for everyday travel and handling different types of roads. Four-wheel drive vehicles have higher engine capacity and maintenance costs, so a lower road tax structure compensates for these costs.

On the other hand, Pangkor, Langkawi, and Labuan are duty-free zones, which entitle them to even lower rates of road tax than East Malaysia. For cars with an engine displacement of less than 1000cc, the fee is RM20.

In Langkawi and Pangkor, cars bigger than 1000cc pay about half what they do elsewhere in Peninsular Malaysia. Labuan has the cheapest road tax rates in Malaysia, with drivers paying only 50% of the price in East Malaysia.

Note: To calculate your road tax, the location where you currently keep your vehicle will be factored in, not the location where it was registered, so a Sabah-registered car that is used in KL will be subject to West Malaysia's rate.

Vehicle Body Type

On Malaysian roads, all cars are classified as "saloons" or "non-saloons." Sedans, hatchbacks, coupes, wagons, and convertibles are classified as saloons.

MPVs, SUVs, and pickup trucks, categorised as non-saloon vehicles, have a higher road tax base rate. However, when you cross a certain engine size, the rate can be cheaper than a saloon car with the same cubic capacity.

Saloon cars have a higher progressive rate when the engine capacity surpasses 1600cc as compared to non-saloon cars.

Important: The most common mistake people make is choosing the wrong type of vehicle, which results in an incorrect amount of road tax. When purchasing the road tax, be sure to choose the right type of vehicle.

Ownership

A company-registered car will have higher road tax rates, but this only applies to saloon cars. Interestingly, both private and company-registered vehicles pay the same rate as non-saloon cars.

What about Electric Vehicles (EV)?

In the latest update from JPJ, electric vehicles (EV) in Malaysia will be charged according to their motor kilowatt output rather than their engine displacement. Additionally, electric vehicles will be priced based on whether they are saloon or non-saloon models. The price will not be affected whether they are privately or company registered.

The road tax for electric motorcycles starts at RM2 as well, but you'll only have to pay RM42 once the output exceeds 40,000W (40kW).

However, if you're planning to own an electric vehicle, you'll be glad to know that all full electric vehicles that are powered by a battery (BEV) or by fuel cells (FCEV) will be exempt from road tax until 31 December 2025.

Road Tax Rates

Next, let's look at JPJ's base rates and progressive rates for all types of vehicles:

Private Registered Saloon Cars in Peninsular Malaysia

|

Cubic Capacity (cc) |

Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | - |

| 1001 to 1200 | RM55.00 | - |

| 1201 to 1400 | RM70.00 | - |

| 1401 to 1600 | RM90.00 | - |

| 1601 to 1800 | RM200.00 | RM0.40 (for every cc increase from 1600) |

| 1801 to 2000 | RM280.00 | RM0.50 (for every cc increase from 1800) |

| 2001 to 2500 | RM380.00 | RM1.00 (for every cc increase from 2000) |

| 2501 to 3000 | RM880.00 | RM2.50 (for every cc increase from 2500) |

| 3001 and above | RM2130.00 | RM4.50 (for every cc increase from 3000) |

Company Registered Saloon Cars in Peninsular Malaysia

|

Cubic Capacity (cc) |

Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | - |

| 1001 to 1200 | RM110.00 | - |

| 1201 to 1400 | RM140.00 | - |

| 1401 to 1600 | RM180.00 | - |

| 1601 to 1800 | RM400.00 | RM0.80 (for every cc increase from 1600) |

| 1801 to 2000 | RM560.00 | RM1.00 (for every cc increase from 1800) |

| 2001 to 2500 | RM760.00 | RM3.00 (for every cc increase from 2000) |

| 2501 to 3000 | RM2260.00 | RM7.50 (for every cc increase from 2500) |

| 3001 and above | RM6010.00 | RM13.50 (for every cc increase from 3000) |

Company and Private Registered Non-Saloon Cars in Peninsular Malaysia

|

Cubic Capacity (cc) |

Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | - |

| 1001 to 1200 | RM85.00 | - |

| 1201 to 1400 | RM100.00 | - |

| 1401 to 1600 | RM120.00 | - |

| 1601 to 1800 | RM300.00 | RM0.30 (for every cc increase from 1600) |

| 1801 to 2000 | RM360.00 | RM0.40 (for every cc increase from 1800) |

| 2001 to 2500 | RM440.00 | RM0.80 (for every cc increase from 2000) |

| 2501 to 3000 | RM840.00 | RM1.60 (for every cc increase from 2500) |

| 3001 and above | RM1640.00 | RM1.60 (for every cc increase from 3000) |

Company and Private Registered Saloon Cars in East Malaysia

|

Cubic Capacity (cc) |

Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | - |

| 1001 to 1200 | RM44.00 | - |

| 1201 to 1400 | RM56.00 | - |

| 1401 to 1600 | RM72.00 | - |

| 1601 to 1800 | RM160.00 | RM0.32 (for every cc increase from 1600) |

| 1801 to 2000 | RM224.00 | RM0.25 (for every cc increase from 1800) |

| 2001 to 2500 | RM524.00 | RM1.00 (for every cc increase from 2000) |

| 2501 to 3000 | RM880.00 | RM2.50 (for every cc increase from 2500) |

| 3001 and above | RM1024.00 | RM1.35 (for every cc increase from 3000) |

Company and Private Registered Non-Saloon Cars in East Malaysia

|

Cubic Capacity (cc) |

Base Rate | Progressive Rate (per cc) |

| 1000 and below | RM20.00 | - |

| 1001 to 1200 | RM42.50 | - |

| 1201 to 1400 | RM50.00 | - |

| 1401 to 1600 | RM60.00 | - |

| 1601 to 1800 | RM165.00 | RM0.17 (for every cc increase from 1600) |

| 1801 to 2000 | RM199.00 | RM0.22 (for every cc increase from 1800) |

| 2001 to 2500 | RM243.00 | RM0.44 (for every cc increase from 2000) |

| 2501 to 3000 | RM463.00 | RM0.88 (for every cc increase from 2500) |

| 3001 and above | RM903.00 | RM1.20 (for every cc increase from 3000) |

Company and Private Registered Saloon Electric Vehicles

|

Motor Output (W) |

Base Rate | Progressive Rate (per 50W) |

| 50000 and below | RM20.00 | - |

| 50001 to 60000 | RM44.00 | - |

| 60001 to 70000 | RM56.00 | - |

| 70001 to 80000 | RM72.00 | - |

| 80001 to 90000 | RM160.00 | RM0.32 (for every 50W increase from 80000) |

| 90001 to 100000 | RM224.00 | RM0.25 (for every 50W increase from 100000) |

| 100001 to 125000 | RM274.00 | RM0.50 (for every 50W increase from 100000) |

| 125001 to 150000 | RM524.00 | RM1.00 (for every 50W increase from 125000) |

| 150001 and above | RM1024.00 | RM1.35 (for every 50W increase from 150000) |

Company and Private Registered Non-Saloon Electric Vehicles

|

Motor Output (W) |

Base Rate | Progressive Rate (per 50W) |

| 50000 and below | RM20.00 | - |

| 50001 to 60000 | RM42.50 | - |

| 60001 to 70000 | RM50.00 | - |

| 70001 to 80000 | RM60.00 | - |

| 80001 to 90000 | RM165.00 | RM0.17 (for every 50W increase from 80000) |

| 90001 to 100000 | RM199.00 | RM0.22 (for every 50W increase from 90000) |

| 100001 to 125000 | RM243.00 | RM0.44 (for every 50W increase from 100000) |

| 125001 to 150000 | RM463.00 | RM0.88 (for every 50W increase from 125000) |

| 150001 and above | RM903.00 | RM1.20 (for every 50W increase from 150000) |

Motorcycles in Peninsular Malaysia

|

Cubic Capacity (cc) |

Base Rate |

| 150 and below | RM2.00 |

| 151 to 200 | RM30.00 |

| 201 to 250 | RM50.00 |

| 251 to 500 | RM100.00 |

| 501 to 800 | RM250.00 |

| 801 and above | RM350.00 |

Motorcycles in East Malaysia

|

Cubic Capacity (cc) |

Base Rate |

| 150 and below | RM2.00 |

| 151 to 200 | RM9.00 |

| 201 to 250 | RM12.00 |

| 251 to 500 | RM30.00 |

| 501 to 800 | RM40.00 |

| 801 and above | RM42.00 |

Electric motorcycles

|

Motor Output (W) |

Base Rate |

| 7500 and below | RM2.00 |

| 7501 to 10000 | RM9.00 |

| 10001 to 12500 | RM12.00 |

| 12501 to 25000 | RM30.00 |

| 25001 to 40000 | RM40.00 |

| 40001 and above | RM42.00 |

Calculating the Road Tax

So now that you know what factors determine the road tax price and the progressive rate formula, here's a sample calculation:

Car Model: Mazda 3, 1998cc

Location: Peninsular Malaysia

Type: Saloon

Usage: Private

Base rate: RM280

Progressive rate

1998cc - 1800cc = 198

198 x RM0.50 = RM99

Total road tax amount

Base rate + Progressive rate

RM280 + RM99 = RM379

Car Road Tax Price List

Below, you will find the different road tax price lists for a variety of popular types of cars. Use the browser search function (Ctrl + F) to locate your model in the long list quickly.

Tip: Use our insurance quote & road tax calculator if your vehicle isn't listed or if you wish to calculate both your insurance premiums and road tax.

Disclaimer: Road tax prices stated are correct at time of publication and may be subject to change without notice. Please refer to JPJ for any changes.

Road Tax Price for Perodua Models (Private Registered) 2023

Model |

Cubic Capacity |

Peninsular Malaysia |

Sabah & Sarawak |

| Ativa 1.0 | 998 | RM20.00 | RM20.00 |

| Myvi 1.3 | 1329 | RM70.00 | RM56.00 |

| Myvi 1.5 | 1496 | RM90.00 | RM72.00 |

| Aruz 1.5 | 1496 | RM120.00 | RM60.00 |

| Axia 1.0 | 998 | RM20.00 | RM20.00 |

| Bezza 1.0 | 998 | RM20.00 | RM20.00 |

| Bezza 1.3 | 1329 | RM70.00 | RM56.00 |

| Alza 1.5 | 1495 | RM120.00 | RM60.00 |

| Viva 660 | 659 | RM20.00 | RM20.00 |

| Viva 850 | 847 | RM20.00 | RM20.00 |

| Viva 1.0 | 989 | RM20.00 | RM20.00 |

Road Tax Price for Proton Models (Private Registered) 2023

Model |

Cubic Capacity |

Peninsular Malaysia |

Sabah & Sarawak |

| X50 1.5 | 1477 | RM120.00 | RM60.00 |

| X70 1.8 | 1799 | RM359.70 | RM198.83 |

| Saga 1.3 | 1332 | RM70.00 | RM56.00 |

| Persona 1.6 | 1597 | RM90.00 | RM72.00 |

| Iriz 1.3 | 1332 | RM70.00 | RM56.00 |

| Iriz 1.6 | 1597 | RM90.00 | RM72.00 |

| Exora 1.6 | 1561 | RM120.00 | RM60.00 |

| Preve 1.6 | 1561 | RM90.00 | RM72.00 |

| Perdana 2.0 | 1997 | RM378.50 | RM273.25 |

| Perdana 2.4 | 2354 | RM734.00 | RM451.00 |

| Waja 1.6 | 1597 | RM90.00 | RM72.00 |

| Waja 1.8 | 1784 | RM273.60 | RM218.88 |

| Wira 1.3 | 1299 | RM70.00 | RM56.00 |

| Wira 1.5 | 1468 | RM90.00 | RM72.00 |

| Wira 1.6 | 1597 | RM90.00 | RM72.00 |

| Wira 1.8 | 1834 | RM297.00 | RM232.50 |

Road Tax Price for Mazda Models (Private Registered) 2023

Model |

Cubic Capacity |

Peninsular Malaysia |

Sabah & Sarawak |

| Mazda 2 1.5 | 1496 | RM90.00 | RM72.00 |

| Mazda 3 1.5 | 1496 | RM90.00 | RM72.00 |

| Mazda 3 2.0 | 1998 | RM379.00 | RM273.50 |

| Mazda 6 2.0 | 1998 | RM379.00 | RM273.50 |

| Mazda 6 2.5 | 2488 | RM868.00 | RM518.00 |

| CX-3 2.0 | 1998 | RM439.20 | RM242.56 |

| CX-5 2.0 | 1998 | RM439.20 | RM242.56 |

| CX-5 2.2 | 2191 | RM592.80 | RM327.04 |

| CX-5 2.5 | 2488 | RM830.40 | RM457.72 |

| CX-8 2.5 | 2488 | RM830.40 | RM457.72 |

| CX-9 2.5 | 2488 | RM830.40 | RM457.72 |

| MX-5 RF | 1998 | RM379.00 | RM273.50 |

| CX-30 1.8 | 1759 | RM347.70 | RM192.03 |

| CX-30 2.0 | 1998 | RM439.20 | RM242.56 |

| BT-50 1.9 | 1898 | RM399.20 | RM220.56 |

| BT-50 3.0 | 2999 | RM1638.40 | RM902.12 |

Road Tax Price for Toyota Models (Private Registered) 2023

Model |

Cubic Capacity |

Peninsular Malaysia |

Sabah & Sarawak |

| GR Supra 3.0 | 2998 | RM2125.00 | RM1022.00 |

| GR Yaris 1.6 | 1618 | RM207.20 | RM165.76 |

| Vios GR-S 1.5 | 1496 | RM90.00 | RM72.00 |

| Vios 1.5 | 1496 | RM90.00 | RM72.00 |

| Yaris 1.5 | 1496 | RM90.00 | RM72.00 |

| Corolla (Altis) 1.8 | 1798 | RM279.20 | RM223.36 |

| Camry 2.5 | 2494 | RM874.00 | RM521.00 |

| Avanza 1.5 | 1496 | RM120.00 | RM60.00 |

| Innova 2.0 | 1998 | RM439.20 | RM242.56 |

| Alphard 3.5 | 3456 | RM2369.60 | RM1450.20 |

| Vellfire 2.5 | 2494 | RM835.20 | RM460.36 |

| Vellfire 3.5 | 3456 | RM2369.60 | RM1450.20 |

| Rush 1.5 | 1496 | RM120.00 | RM60.00 |

| Corolla Cross 1.8 | 1798 | RM359.40 | RM198.66 |

| Fortuner 2.4 | 2393 | RM754.40 | RM415.92 |

| Fortuner 2.7 | 2694 | RM1150.40 | RM633.72 |

| Fortuner 2.8 | 2755 | RM1248.00 | RM687.40 |

| RAV4 2.5 | 2487 | RM829.60 | RM457.28 |

| Harrier 2.0 | 1987 | RM434.80 | RM240.14 |

| Hilux 2.4 | 2393 | RM754.40 | RM415.92 |

| Hilux 2.8 | 2755 | RM1248.00 | RM687.40 |

Road Tax Price for Honda Models (Private Registered) 2023

Model |

Cubic Capacity |

Peninsular Malaysia |

Sabah & Sarawak |

| Accord 1.5 | 1498 | RM90.00 | RM72.00 |

| BR-V 1.5 | 1497 | RM90.00 | RM72.00 |

| City 1.5 | 1498 | RM90.00 | RM72.00 |

| Civic 1.5 | 1498 | RM90.00 | RM72.00 |

| Civic 1.8 | 1799 | RM279.60 | RM223.68 |

| CR-V 1.5 | 1498 | RM120.00 | RM60.00 |

| CR-V 2.0 | 1997 | RM438.80 | RM242.34> |

| HR-V 1.8 | 1799 | RM359.70 | RM198.83 |

| Jazz 1.5 | 1497 | RM90.00 | RM72.00 |

| Type R 2.0 | 1996 | RM378.00 | RM273.00 |

Road Tax Price for Nissan Models (Private Registered) 2023

Model |

Cubic Capacity |

Peninsular Malaysia |

Sabah & Sarawak |

| Almera 1.0 | 999 | RM20.00 | RM20.00 |

| Almera 1.5 | 1498 | RM90.00 | RM72.00 |

| X-Trail 2.0 | 1997 | RM438.80 | RM242.34 |

| X-Trail 2.5 | 2488 | RM830.40 | RM457.72 |

| Navara 2.5 | 2488 | RM830.40 | RM457.72 |

| Serena S-Hybrid 2.0 | 1997 | RM438.80 | RM242.34 |

| Grand Livina 1.6 | 1598 | RM120.00 | RM60.00 |

| Grand Livina 1.8 | 1798 | RM359.40> | RM198.66 |

| Sentra 1.6 | 1597 | RM90.00 | RM72.00 |

| Sylphy 1.8 | 1798 | RM279.20> | RM223.36 |

| Teana 2.0 | 1997 | RM378.50 | RM273.25 |

| Teana 2.5 | 2488 | RM868.00 | RM518.00 |

Road Tax Price for Hyundai Models (Private Registered) 2023

Model |

Cubic Capacity |

Peninsular Malaysia |

Sabah & Sarawak |

| Elantra 1.6 | 1598 | RM90.00 | RM72.00 |

| i30 N 2.0 | 1998 | RM379.00 | RM273.50 |

| Sonata 2.5 | 2497 | RM877.00 | RM522.50 |

| Kona 1.6 | 1598 | RM120.00 | RM60.00 |

| Kona 2.0 | 1999 | RM439.60 | RM242.78 |

| Santa Fe 2.2 | 2199 | RM599.20 | RM330.56 |

| Santa Fe 2.4 | 2359 | RM727.20> | RM400.96 |

| Grand Starex 2.5 | 2497 | RM837.60 | RM461.68 |

| Staria 2.2 | 2199 | RM599.20 | RM330.56 |

| Ioniq 1.6 | 1580 | RM90.00 | RM72.00 |

| Tucson 1.6 | 1591 | RM120.00 | RM60.00 |

| Tucson 2.0 | 1999 | RM439.60 | RM242.78 |

Road Tax Price for BMW Models (Private Registered) 2023

Model |

Cubic Capacity |

Peninsular Malaysia |

Sabah & Sarawak |

| 2 Series 1.5 | 1499 | RM90.00 | RM72.00 |

| 3 Series 2.0 | 1998 | RM379.00 | RM273.50 |

| 4 Series 2.0 | 1998 | RM379.00 | RM273.50 |

| 5 Series 2.0 | 1998 | RM379.00 | RM273.50 |

| 6 Series 2.0 | 1998 | RM379.00 | RM273.50 |

| 7 Series 3.0 | 2998 | RM2125.00 | |

| 8 Series 3.0 | 2998 | RM2125.00 | RM1022.00 |

| X1 1.5 | 1499 | RM120.00 | RM60.00 |

| X1 2.0 | 1998 | RM439.20 | RM242.56 |

| X3 2.0 | 1998 | RM439.20 | RM242.5 |

| X4 2.0 | 1998 | RM439.20 | RM242.56 |

| X5 3.0 | 2998 | RM1636.80 | RM901.24 |

| X6 3.0 | 2998 | RM1636.80 | RM901.24 |

| X7 xDrive40i 3.0 | 2998 | RM1636.80 | RM901.24 |

| X7 M50i 4.4 | 4395 | RM3872.00 | RM2577.00 |

| X7 xDrive30d 3.0 | 2993 | RM1628.80 | RM896.84 |

| X7 xDrive40d 3.0 | 2993 | RM1628.80 | RM896.84 |

| X7 M50d 3.0 | 2993 | RM1628.80 | RM896.84 |

| Z4 2.0 | 1998 | RM379.00 | RM273.50 |

| M135i xDrive 2.0 | 1998 | RM379.00 | RM273.50 |

| M2 3.0 | 2979 | RM2077.50 | |

| M340i xDrive 3.0 | 2998 | RM2125.00 | RM1022.00 |

| M3 3.0 | 2993< | RM2112.50 | RM1017.00 |

| M4 3.0 | 2993< | RM2112.50 | RM1017.00 |

| M5 4.4 | 4395 | RM8407.50 | RM2907.25< |

| M8 4.4 | 4395 | RM8407.50 | RM2907.25 |

| X3 M 3.0 | 2993 | RM1628.80 | RM896.84 |

| X4 M 3.0 | 2993 | >RM1628.80 | RM896.84 |

Road Tax Price for Mercedes-Benz Models (Private Registered) 2023

Model |

Cubic Capacity |

Peninsular Malaysia |

Sabah & Sarawak |

| A-Class 1.3 | 1332 | RM70.00 | RM56.00 |

| A-Class 2.0 | 1991 | RM375.50 | RM271.75 |

| C-Class 1.5 | 1497 | RM90.00 | RM72.00 |

| C-Class 2.0 | 1991 | RM375.50 | RM271.75 |

| AMG C-Class 3.0 | 2996 | RM2120.00 | RM1020.00 |

| AMG C-Class 4.0 | 3982 | RM6549.00 | RM2349.70 |

| E-Class 2.0 | 1991 | RM375.50 | RM271.75< |

| E-Class 3.0 | 2996 | RM2120.00 | RM1020.00 |

| S-Class 3.0 (Diesel) | 2925 | RM1942.50 | RM949.00 |

| S-Class 3.0 (Petrol) | 2999 | RM2127.50 | RM1023.00 |

| S-Class 3.0 (S500) | 2987 | RM2097.50 | RM1011.00 |

| S-Class 4.0 | 3982 | RM6549.00 | RM2349.70 |

| S-Class 6.0 | 5980 | RM15540.00 | RM5047.00 |

| S 400 L 3.5 | 3498 | RM4371.00 | RM1696.30 |

| Mercedes-Maybach S-Class 4.0 | 3982 | RM6549.00 | RM2349.70 |

| Mercedes-Maybach S-Class 6.0 | 5980 | RM15540.00 | RM5047.00 |

| Mercedes-AMG S-Class 4.0 | 3982 | RM6549.00 | RM2349.70 |

| Mercedes-AMG S-Class 6.0 | 5980 | RM15540.00 | RM5047.00 |

| GLA 1.3 | 1332 | RM100.00 | RM50.00 |

| GLA 2.0 | 1991 | RM436.40 | RM241.02 |

| GLB 1.3 | 1332 | RM100.00 | RM50.00 |

| GLB 2.0 | 1991 | RM436.40 | RM241.02 |

| GLC 2.0 | 1991 | RM436.40 | RM241.02 |

| GLC Coupe 2.0 | 1991 | RM436.40 | RM241.02 |

| GLE 3.0 | 2999 | RM1638.40 | RM902.12 |

| GLE Coupe 3.0 | 2999 | RM1638.40 | RM902.12 |

| GLS 3.0 | 2996 | RM1633.40 | RM899.48 |

| AMG G-Class 4.0 | 3982 | RM3211.20 | RM2081.40 |

| AMG G-Class 5.5 | 5461 | RM5577.60 | RM3856.20 |

| CLA 1.6 | 1595 | RM90.00 | RM72.00 |

| CLA 2.0 | 1991 | RM375.50 | RM271.75 |

| E-Class Coupe 2.0 | 1991 | RM375.50 | RM271.75 |

Road Tax Price for Suzuki Models (Private Registered) 2023

Model |

Cubic Capacity |

Peninsular Malaysia |

Sabah & Sarawak |

| Swift Sport 1.4 | 1373 | RM70.00 | RM56.00 |

| Jimny 1.5 | 1462 | RM120.00 | RM60.00 |

| Grand Vitara 2.0 | 1995 | RM438.00 | RM241.90 |

| SX-4 1.6 | 1586 | RM90.00 | RM72.00 |

| Kizashi 2.4 | 2393 | RM773.00 | RM470.50 |

| Alto 1.0 | 996 | RM20.00 | RM20.00 |

Road Tax Price for Ford Models (Private Registered) 2023

Model |

Cubic Capacity |

Peninsular Malaysia |

Sabah & Sarawak |

| Ranger Raptor X 2.0 | 1996 | RM438.40 | RM242.12 |

| Ranger Raptor 2.0 | 1996 | RM438.40 | RM242.12 |

| Ranger WildTrak Sport 2.0 | 1996 | RM438.40 | RM242.12 |

| Ranger WildTrak 2.0 | 1996 | RM438.40 | RM242.12 |

| Ranger XLT 2.0 | 1996 | RM438.40 | RM242.12 |

| Ranger XLT 2.2 | 2198 | RM598.40 | RM330.12 |

| Ranger XLT Plus 2.0 | 1996 | RM438.40 | RM242.12 |

| Ranger XL 2.0 | 1996 | RM438.40 | RM242.12 |

| Everest 2.0 | 1996 | RM438.40 | RM242.12 |

| Mustang 2.3 | 2261 | RM641.00 | RM404.50 |

| Mustang 5.0 | 4951 | RM10909.50 | RM3657.85 |

| Fiesta Sport 1.0 | 998 | RM20.00 | RM20.00 |

| Fiesta Sport 1.5 | 1498 | RM90.00 | RM72.00 |

| Focus 1.5 | 1498 | RM90.00 | RM72.00 |

| Focus 2.0 | 1999 | RM379.50 | RM273.75 |

Disclaimer: This blog post is strictly for informational purposes, and should not be taken as advice of any kind. Kurnia disclaims all responsibility for any losses resulting from reliance on the information contained in this article.